06 Jun Safe Harbor for Your Charitable Deduction

Landowners Nationwide with a Conservation Easement Should Revise Deeds by July 24th or Risk Losing Their Charitable Deduction

By David E. Bowers, LL.M. and Rachel L. Sears

If you have generously donated a conservation easement as a landowner, it is crucial to be aware that your charitable deduction may be jeopardized if your deed does not incorporate the prescribed safe harbor language by a deadline of July 24, 2023, as mandated by the Internal Revenue Service (IRS).

The Treasury Department and the IRS issued Notice 2023-30, which outlines safe harbor deed language for extinguishment and boundary line adjustment clauses. The Notice provides two distinct safe harbor clauses for use in conservation easement deeds, one for extinguishment and another for boundary line adjustments. Failure to include these clauses could potentially disqualify the tax deduction generated by your conservation easement.

By including these safe harbor clauses in your easement deed, you will be deemed to have met the requirements set forth by the Treasury regulations. However, it is important to note there is a disagreement among the Sixth and Eleventh circuit courts of appeals regarding the validity of the Treasury regulation in question. The Sixth Circuit upheld the validity of the Treasury regulation in 2020, while the Eleventh Circuit deemed it invalid and unenforceable in 2021. This has significance for taxpayers with easements located in Florida, Georgia, and Alabama. Without the support of the Treasury regulation, the IRS may have a harder time challenging the tax treatment of easement donations based on the failure of the deed to include the safe harbor language regarding extinguishment of easements or boundary line adjustments.

Taxpayers in these three states should consult with qualified professionals and/or their donee organization to undertake actions to make certain their deed is in compliance with applicable laws and regulations.

David E. Bowers

David Bowers, chair of Jones Foster’s Private Wealth, Trusts & Estates and Corporate & Tax practice groups, has over thirty years of experience in complex tax, trusts and estates, and business planning. David is a Florida Bar Board Certified specialist in Tax and has extensive experience in estate planning, estate and trust administration, including IRS audits and business transactions.

Rachel L. Sears

Rachel Sears is a member of Jones Foster’s Private Wealth, Trusts & Estates and Corporate & Tax practice groups. Rachel concentrates her practice in the areas of estate planning, trust and estate administration, and corporate law.

You May Also Like…

-

2025 Palm Beach Kips Bay Decorator Show House

A crash course on our favorite rooms from the Kips Bay Show House ...

01 April, 2025 -

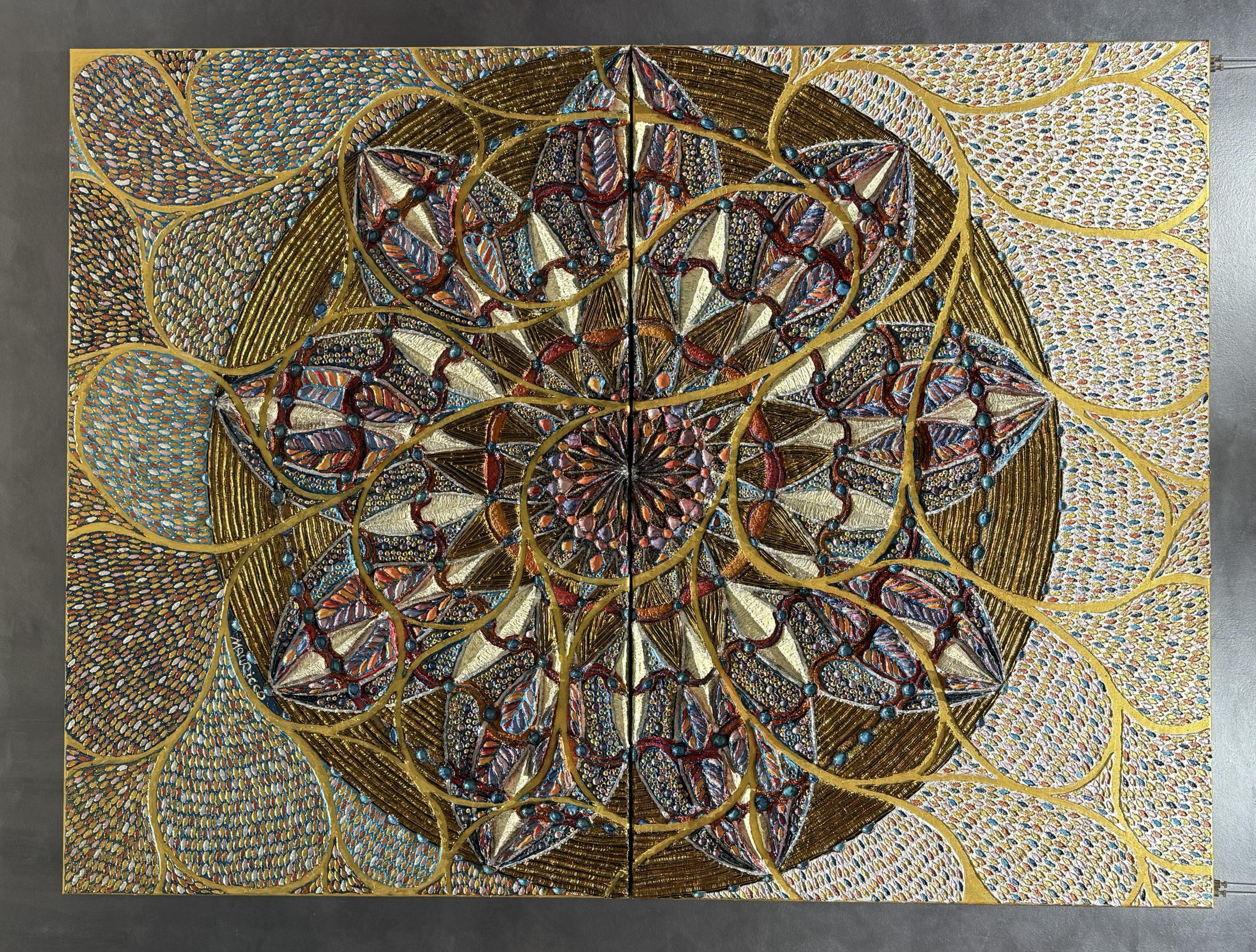

Mauricco Zaraj latest work, Sadalsuud – The Luckiest of the Lucky

A visionary artist, Mauricco Zaraj, shares an intriguing story behind his latest artwork: “Sadalsuud...

26 March, 2025 -

Palm Beach Meets Nantucket

Designer Barbara Lewis creates a multi-generational retreat for a New York family...

18 March, 2025