13 Feb Homestead Planning for Florida Residents with Minor Children

By William G. “Bill” Smith, LL.M. and Erica R. Haft, LL.M

Florida’s homestead protections are deemed to be some of the strongest in the country and thus a compelling consideration for individuals deciding to relocate to Florida. After all, Florida’s Constitution provides that creditors are generally unable to force a sale of a homestead. Therefore, by maintaining a homestead, Florida residents are engaging in asset protection planning of what is typically one of their most valuable assets.

But with these protections come limitations on how the homestead may be devised should the owner pass away. A homestead owned jointly by spouses will pass automatically to the surviving spouse. However, a problematic aspect of Florida homestead law arises when a decedent who owns a homestead in his or her own name is survived by at least one minor child. If the decedent is married at the time of death, the spouse receives a life estate in the homestead and the decedent’s descendants receive equal remainder interest. The spouse does have the option to elect a 50% tenants in common interest in the homestead, and if the election were made the descendants would receive the other 50% as tenants in common.

The same result occurs regardless of whether the decedent died without a will, or with a will or trust which devises the homestead to the decedent’s spouse or to a trust for the decedent’s spouse or children. This result occurs because any devise of the homestead fails when the decedent is survived by at least one minor child. This limitation on devise is designed to protect the spouse and the minor children to ensure that they have a place of shelter even if there is a lack of liquid assets in the decedent’s estate, but, unfortunately, this limitation prohibits any devise to a trust for these same individuals.

Another consequence of Florida’s limitation on devise is that the minor children who receive vested interests in the homestead must be appointed a guardian by the court, and the guardian is responsible for the homestead until the child reaches age 18. Guardianships, however, have many downsides such as the ongoing expenses required to obtain court approval for minor and large decisions, the preparation of accountings annually, compensating the guardian, and the fact that the minor child would receive unrestricted access to the assets upon attaining age 18.

There is an estate planning technique to place the homestead in a trust for the benefit of the children and thereby avoid the need for a guardianship for any minor child. The technique is to create an Irrevocable Homestead Trust for the benefit of the children while one or both parents are still alive. To do this, the parents would transfer the remainder interest in the homestead to the trustee of an Irrevocable Homestead Trust, retaining for themselves a life estate, which would maintain the homestead status of the property (i.e., creditor protections and ad valorem tax benefits) during the parents’ lifetimes. The parents would maintain control of the homestead during their lifetimes through their life estate and as trustees of the trust, and full title to the homestead would revert back to one or both of the parents upon the youngest child reaching age 18. This technique also allows the parents to appoint a successor Trustee who would be responsible for administering the homestead for the benefit of the children, which bypasses the need for guardianship and probate court intervention.

If you own a home in Florida or are planning relocation with children, consulting with an experienced estate planning attorney is highly recommended.

William G. “Bill” Smith

Jones Foster attorney Bill Smith concentrates his practice in the areas of estate planning, estate and trust administration, taxation, and transactional corporate law. Mr. Smith holds a Master of Laws degree in taxation and works with clients to create a customized plan for the current or future transfer of assets to minimize federal gift taxes, estate taxes, and generation-skipping transfer (GST) taxes. He provides counsel to businesses, private foundations, and charities in matters that include business succession planning, transfers of business interests, LLC and S corporation creation, governance documents, mergers, and Treasury Regulation compliance. www.jonesfoster.com

Erica R. Haft

Jones Foster attorney Erica Haft concentrates her practice on tax-oriented estate planning, estate and trust administration, and transactional corporate law. Ms. Haft holds a Master of Laws degree in estate planning and works with clients to create customized estate plans to minimize federal gift taxes, estate taxes, and generation-skipping transfer (GST) taxes. In addition, she devotes a significant portion of her practice to corporate law transactions such as mergers and acquisitions, corporate governance, and corporate restructuring. www.jonesfoster.com

You May Also Like…

-

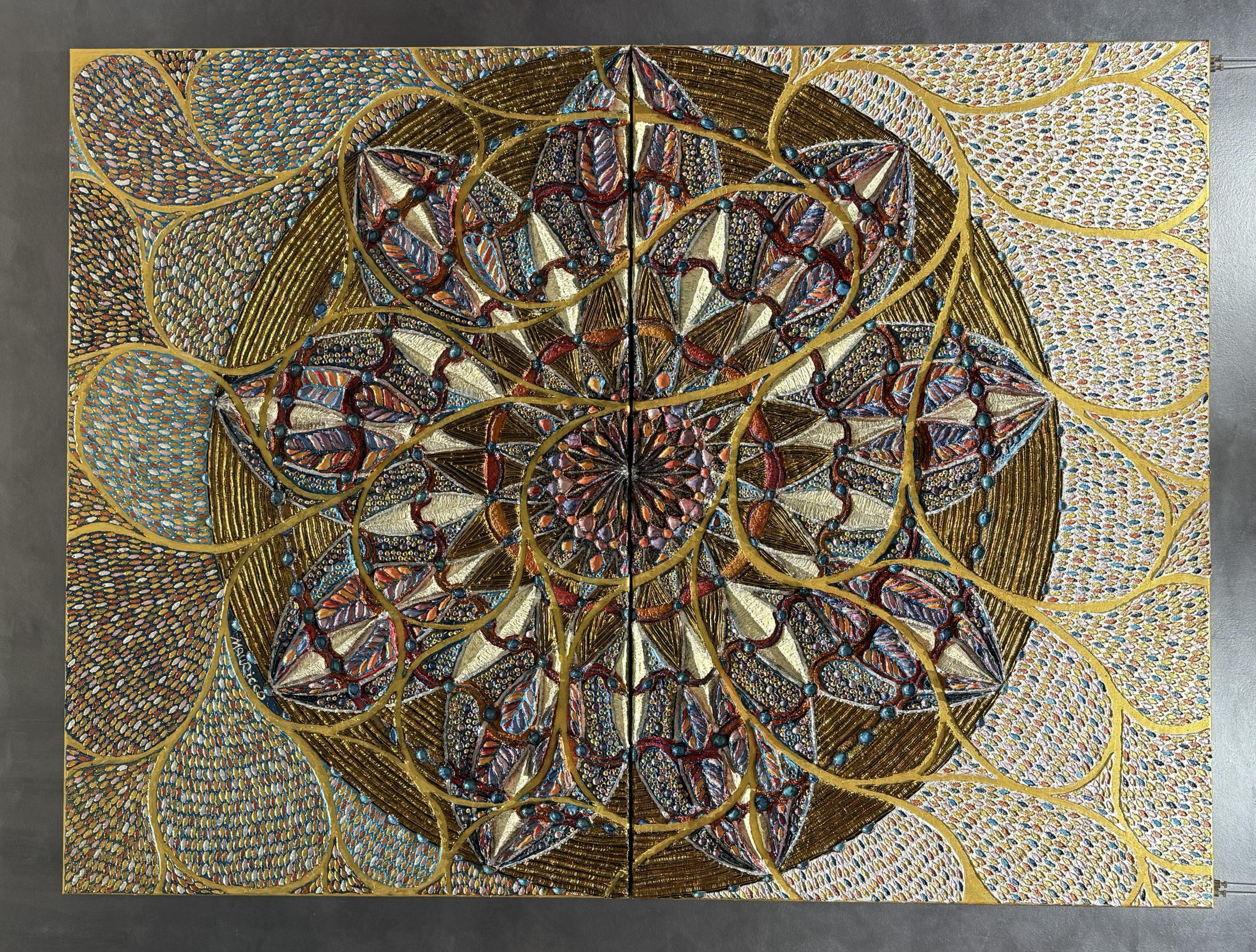

Mauricco Zaraj latest work, Sadalsuud – The Luckiest of the Lucky

A visionary artist, Mauricco Zaraj, shares an intriguing story behind his latest artwork: “Sadalsuud...

26 March, 2025 -

Palm Beach Meets Nantucket

Designer Barbara Lewis creates a multi-generational retreat for a New York family...

18 March, 2025 -

ORO: A Zen Collaboration

Northern Palm Beach County’s most coveted luxury compound hits the market....

07 March, 2025