03 Jul Luxury Trends in Real Estate, Summer 2024

By Anita McLean

We asked four top producing real estate agents from our market area to share their expertise on the state of the luxury real estate market in South Florida, what is shaping buyers’ decisions to purchase homes in South Florida, and the effect of mortgages, geo-political and economic factors on our market.

What are today’s luxury buyers looking for?

All agents agree that buyers today prefer a home that has been updated with modern amenities and luxury finishes. Agent Duerr shares, “Most don’t have the time or desire to do renovations.”

Hot ticket rooms include one or more home offices, a home theater, a home gym, commercial quality kitchens and a secondary kitchen known as a scullery or catering kitchen, higher ceilings, and functional + serene outdoor space.

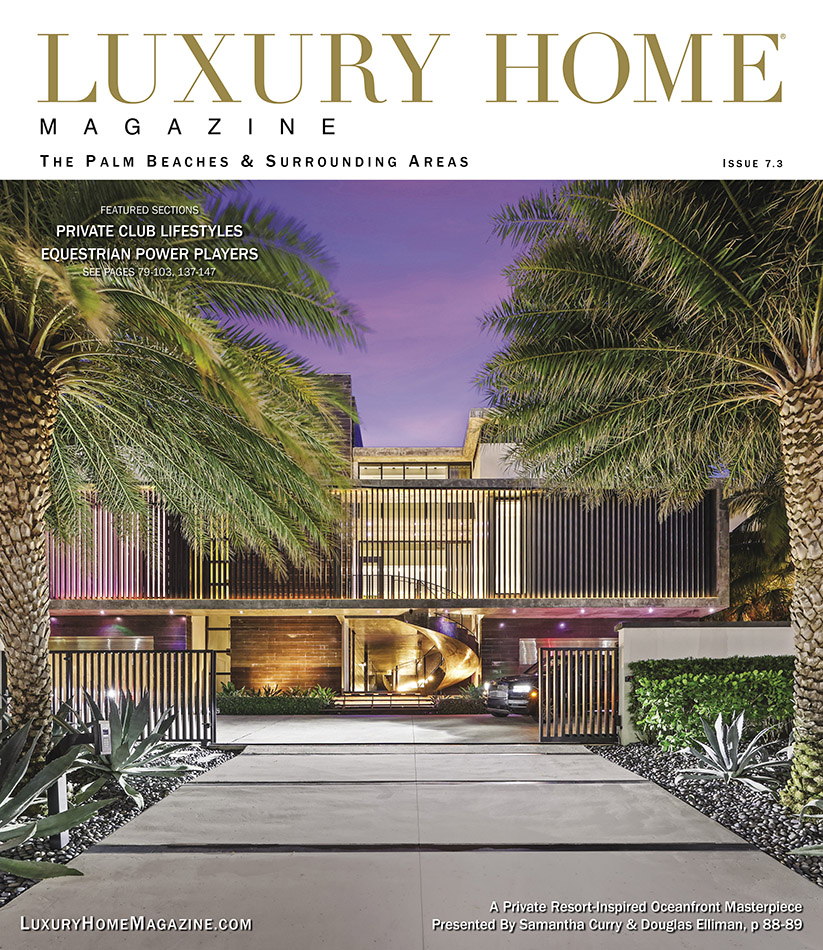

Location matters. All the agents agree that walkability to beaches, coffee shops, restaurants, shopping is increasingly requested. Other frequently requested location are waterfront and private club communities.

Security ranks high on luxury buyers’ lists. Either a gated and walled community or personal gate and walls on their property. Agent Hyland notes the private golf and country club communities are high on her luxury buyers’ list due to their security

In Fort Lauderdale, agent Jones remarks, “In the condo communities, buyers want full concierge services in addition to security. Restaurant services, spa amenities, conference rooms and pool side cabanas rate highly.”

Agent Kilpatrick notes “I’m also seeing a trend of buyers moving away from ultra-contemporary design to a much more natural and organic feel that doesn’t sacrifice modernity.”

Home technology, while interesting to buyers, does not create an urgency to purchase, since many of those items may be added later. People are becoming increasingly aware of solar power options and find them beneficial. Agent Kilpatrick comments, “High-end buyers are always looking for ease of use, and that has naturally led to advanced tech features being expected in new and luxury properties. They’re looking for smart homes with things like motorless shades, advanced climate capabilities, and high-end A/V components, and these features have become so ubiquitous that they’re expected in true luxury homes now.”

Would you say today’s mortgage rates have affected the volume of transactions in your area?

Most of the agents concur that mortgage rates have affected the volume of transactions. Many buyers stayed on the sidelines hoping interest rates would come down and are resigned to purchasing now and re-financing in the future. In the lower echelon of the luxury market, where mortgages are more common, the buyers that are taking a mortgage are working on a smaller overall home purchase budget and home then 1.5 years ago.

The upper echelon of the luxury market has remained relatively unaffected, because most of those transactions are 100% cash. Even if they are not getting a mortgage, it is still part of their thought process, and affects the purchase offer price.

Luxury buyers are taking advantage of different loan programs available. They have strong relationships with their private bankers, who direct them to loan programs that are right for them and their portfolio, often times linked for flexibility.

Some sellers that are wise, educated and open offer credits at closing to buy down the rate, or reduce the offering price. “There is more negotiation going on due the mortgage rates, which is healthy,” comments Agent Duerr.

Any tips for potential homebuyers trying to tap into this market?

Agent Jones shares that sellers are more negotiable in general, and this summer is a good time to buy. She recommends targeting homes where the sellers have strong equity and check for price adjustments as they signal motivation.

Agent Kilpatrick shares, “I continue to believe that buying something in pre-construction is a natural way to get the most prized inventory for the best value. The beauty of the new construction market for potential homebuyers is that they can put a percentage down and have the balance due later, which helps them plan for, and get into, that luxury home with some grace and time that a normal resale would not allow for within an average closing period.”

Agent Duerr recommends, “Be open and willing to make some sacrifices on your wants and needs. Realize you can get into a home that is livable and get better value and appreciation.”

Agent Kilpatrick shares, “What I’m seeing now is that buyers are fed up with ridiculous pricing. They aren’t willing to pay double or more for a property than its last owner did just a few years earlier. Economic conditions are such that people still want to buy 2nd, 3rd, 4th homes, but they’re starting to be more savvy about not overpaying.”

Agent Jones is still seeing home owners relocating to Broward from high taxation states, and believes this trend is here to stay.

Agent Hyland notes that South Florida continues to be the future of luxury real estate and our footprint will most certainly grow over time based on most every projection.

What are the emerging markets and investment opportunities within the luxury real estate sector in your area?

All agents agree pre-construction offers incredible opportunities if you can wait for your new home. They also agree that with low inventory and high building or renovations costs, it is difficult to find fix and flip opportunities.

Agent Hyland states, “With the average home price in Palm Beach now at $14,000,000, many Buyers are moving to the newer frontiers: North County and Martin County. Hobe Sound and Stuart have and will continue to see robust growth in demand and property values. The Brightline train’s upcoming Stuart stop as well as several new upscale golf communities in southern Martin County are both significant factors.”

Agent Duerr sees the best immediate opportunities and ability to negotiate off the asking price in properties that are not brand new or newly renovated, but are move in ready. A home where one can move in, live comfortably, make the renovations later. He recommends buyers ask for seller credits at close to offset the remodels. “Keep an open mind of doing some renovations later on. Make a better deal, choose something that is livable, that you can do a renovation over time,” recommends Agent Duerr.

Agent Jones believes there may be condo opportunities this summer but be careful of assessments of older buildings. A condo community’s financial health is critically important. Agent Jones cautions to beware of poor condo management or overly expensive assessments.

Agent Kilpatrick says, “The best investment opportunities in the Delray Beach area continue to be offered by pre-construction. Buyers who have the vision to plan ahead and buy before a project breaks ground or gets far along in its construction have an advantage in capturing luxury real estate, and are often rewarded with an investment that continues to be highly desirable in our market. A lot of buyers, shy about buying something they can’t see and touch, have missed their opportunity.”

Are there any areas or property types experiencing a surge in demand?

In Palm Beach County, the adjacent areas to the central luxury markets of Palm Beach Island and Jupiter Island there are pockets where home values are increasing at the fast rate. In northern Palm Beach County, Jupiter and Tequesta are in high demand. In West Palm Beach the El Cid, Northwood Village, and SoSo areas are in high demand. Agent Duerr sees a migration of wealth into those markets for the investment opportunity.

In the central Palm Beach County area, Agent Kilpatrick shares, “In the Delray Beach area over the last few years, new construction has been the primary focus of the secondary home market, but demand has been strong across all property types. Delray’s coastal sister cities are also experiencing more new construction activity and higher demand as a result of all the activity in Delray proper.”

In the Fort Lauderdale area Agent Jones sees the gated communities of Harbor Beach, Bay Colony and Sea Ranch Lakes seeing a surge in demand, as well as oceanfront single family homes. She notes there are only so many home sites directly on the ocean.

How are external factors, such as economic conditions and current geopolitical events, influencing our market?

While all the agents agree the Great Migration to Florida has slowed down, they are quick to comment on the favorable taxes and pro-business political climate in our state.

Agent Duerr notes election years tend to influence the market by causing buyer hesitation; they are not as quick to move to the table as they once were. He notes the irony, “The real estate market doesn’t change, and the coastline and weather doesn’t change. The sellers will hold out and wait until after the election, unless they are in a compromised situation and have to sell. We’re in a bit of a stalemate.”

Luxury Expert Panelists

Jonathan Duerr

With over 19 years of experience, Mr. Duerr specializes in luxury and new construction in the West Palm Beach and Palm Beach markets.

305-962-1876 jonathan@albapalmbeach.com

Jennifer Hyland

With career sales over $2 billion, Ms. Hyland is a luxury specialist in the North Palm Beach County and Martin County luxury waterfront and private club market.

561-632-4042 jennifer.hyland@corcoran.com

Julie Jones

With career sales over $2.5 billion, Ms. Jones specializes in the Ft. Lauderdale and Broward county luxury waterfront market.

954-328-3665 julie.jones@elliman.com

Jennifer Kilpatrick

With career sales over half a billion dollars, Ms. Kilpatrick specializes in luxury, waterfront and new construction in the Delray Beach, Boca Raton and coastal sister cities.

561-573-2573 jennifer.kilpatrick@corcoran.com

Visit Luxury Home Magazine of The Palm Beaches to discover more features of the Palm Beach area.

You May Also Like…

-

Eastern Accents: Run for the Roses Collection

Gallop off into the sunset with Equestrian pillows for Eastern Accents, our tribute to the elegance ...

24 June, 2025 -

High Point’s Spring 2025 Market

A peek into new and noteworthy products debuting at High Point Spring Market ...

09 June, 2025 -

A Conversation with Julie Roberts, Owner Palm Beach Art Collection

The Palm Beach Art Collection provides collectors with unique - one of a kind - beautiful paintings ...

30 May, 2025